When manually backtesting a new trading strategy in MT4, some traders plot out their entry, stop loss, and take profit levels at each trading setup (like I did in the image above). However, this can be tedious – especially if you plan to take a hundred or more backtesting trades. See more: trading strategies, example trading strategies, backtesting trading systems excel forex, freelance programmer wanted writing trading strategies mql4, afl trading strategies, auto trading strategies ninja, backtesting trading strategies excel, outsourced backtesting trading strategies, binary option trading strategies, loan trading. Backtesting - MT4 strategy tester When traders enter the market, whether it’s Forex, stocks, or anything else, they employ a certain trading strategy that is ultimately designed to increase their profitable outcomes. MT4 Metatrader 4 Tutorial and Walkthrough showing the functionality and tools I believe every trader should know about. MT4 is the most common trading platform on the planet for Forex Trading. This is a walkthrough tutorial of the platform with commonly used features, Expert Adviser / EA / Robot installation. Forex Tester is a popular strategy backtesting tool for MT4. The tool requires no coding and it even provides traders with some pre-formed strategies. With Forex Tester, you can also apply multiple time frames and the tool automatically tracks your trading results whenever a trade is closed. To use Forex Tester.

- Backtesting Trading Strategies Mt4 Login

- Backtesting Trading Strategies Mt4 Tutorial

- Backtesting In Mt4

- Backtesting Trading Strategies Mt4 Download

Learning how to backtest a trading strategy is one of the most important skills in improving trading performance. After all, trading is about making decisions and it is difficult to make decisions when the outcome is unknown. While past performance does not guarantee future performance, backtesting a strategy to learn about the frequency of wins and losses and other data points, can help the trader have more confidence in implementing their system.

What is backtesting trading?

In order to do backtesting successfully a trader first needs to have a trading strategy with a set of rules. This could be a manual strategy where traders find the setups themselves or even an automated trading strategy in which a computer algorithm takes the trades. The two approaches differ when it comes to backtesting.

When learning how to backtest a trading strategy manually a trader would go back in history to find all of the trades that would have met their trading strategy rules and then record that data in a journal. With this data, the trader can then see the historical wins and losses, the largest run-ups in the account, the largest drawdowns, the consecutive win to loss ratio and many other data points. This will then give the trader confidence in how effective the system is and whether to trade it live.

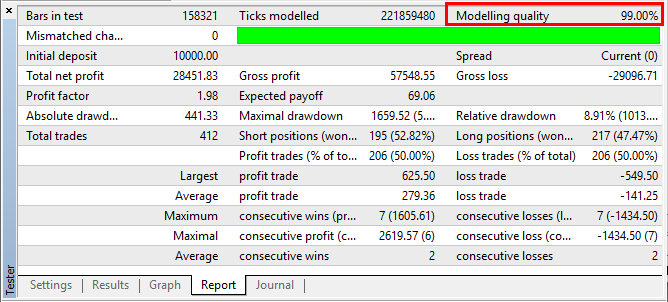

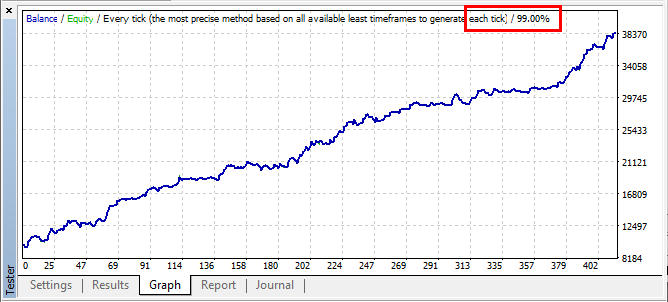

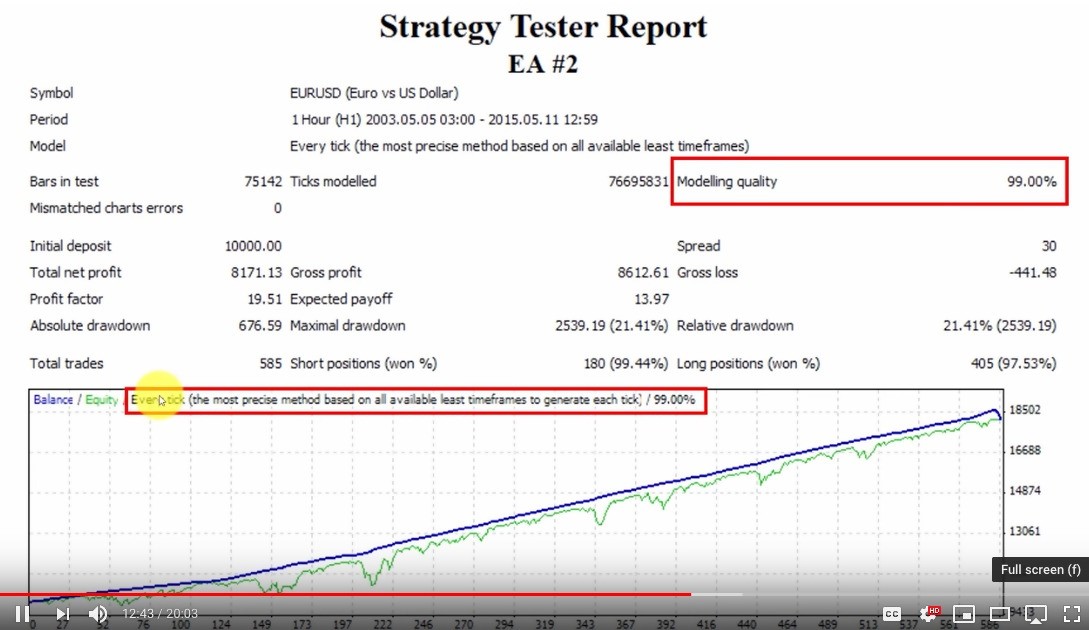

Another option is to learn how to backtest a trading strategy in MT4 (MetaTrader 4) or MT5 (MetaTrader 5), a popular trading and backtesting platform that can be downloaded for free from Admiral Markets UK Ltd. This method is very popular among automated traders. Once they have programmed their trading system using an Expert Advisor or using a free one from the MetaTrader Market place, then the MetaTrader trading platform will automatically find all of the previous trades that met the rules coded into the system and provide a historical and detailed report, similar to the one below:

A screenshot of a hypothetical trading system's historical backtested results from MetaTrader.

Did you know that you can download the MetaTrader 4 trading platform provided by Admiral Markets completely FREE? With this trading platform you can trade directly from the chart and use algorithmic trading strategies as well! Start your FREE download by clicking the banner below:

How to backtest a trading strategy

Whether you are learning how to backtest a Forex trading strategy or learning how to backtest a stock strategy, learning how to backtest a trading strategy using Excel is important. It is one of the best ways to get started in the financial markets, to build confidence in yourself and your system.

The process of backtesting a strategy manually is powerful because it allows beginner traders to condition their minds with the right visual image. Trading is as much about pattern recognition as it is analysing the numbers. The more you can build your memory bank of what you should be trading and what you should not be trading, the more likely you are to make better decisions in the future.

However, in order to start backtesting, a trader first needs a trading strategy to test.

How to build a trading strategy

There are a variety of ways to build a trading strategy. The core and most basic components should be the following inputs:

1. Which instruments will you trade on?

Identifying the markets and symbols you want to trade on is essential. A strategy that may be effective on indices may not work at all on Forex markets. While it doesn't matter which markets you will trade on, it is important to have a focus. For example, many Forex traders would first start with the major currency pairs against the US dollar. With Admiral Markets you can trade CFDs ( Contracts for Difference) on more than 3,000+ instruments which include Forex, indices, stocks, commodities and others.

2. Which time frames will you trade on?

Backtesting a strategy on the daily chart and then trying to trade it on an hourly chart would lead to some very different results. It is important to identify the time frame you plan to trade on. Will it be the daily chart, four-hour or one-hour chart for example? The MetaTrader trading platform provided by Admiral Markets provides access to a variety of different time frames to trade on.

An example chart showing a variety of different trading tools and indicators. DISCLAIMER: Charts for financial instruments in this article are for illustrative purposes and do not constitute trading advice or a solicitation to buy or sell any financial instrument provided by Admiral Markets (CFDs, Exchange Traded Funds, Shares). Past performance is not necessarily an indication of future performance.

3. What tools will you use to buy or sell?

When traders make trading decisions they usually use different tools to help them. These tools could be from technical analysis or fundamental analysis with the former being the most popular. In technical analysis, traders will use chart patterns and trading indicators to make trading decisions on when to buy or sell. Defining your tools is essential in backtesting as you need to know what you are looking for.

4. How will you risk manage your trades?

Risk management is a key component of long-term trading success. How much will you risk per trade? Where will you put your stop loss and take profit? When looking back at historical trades it's important to have this information ready to make the backtesting results more meaningful.

Did you know that you can upgrade your MetaTrader trading platform provided by Admiral Markets to the Supreme Edition? This will allow you access to automated analytical tools which scan for a wide variety of trading patterns on more than 3,000+ asset classes! Start your upgrade completely FREE by clicking on the banner below:

How to perform a backtest

Backtesting Trading Strategies Mt4 Login

Once you are armed with your trading strategy rules you can now look back historically to find examples of when they have occurred in the past. This data should be recorded in an Excel spreadsheet so you can quickly filter for best performing days and quickly see data points such as consecutive winning and losing trades.

The Excel spreadsheet for backtesting could like this (a hypothetical example with random figures):

Month | Day | Strategy | Symbol | L/S | Entry | SL | TP | Risk | Reward | W/L | Comments |

August | Tues | Forex H4 | EURUSD | Long | 1.19 | 1.18 | 1.2 | -100 | 100 | W | |

August | Wed | Forex H1 | EURUSD | Short | 1.19 | 1.2 | 1.18 | -100 | -100 | L |

After a larger sample size has developed, users can then add up the wins and losses and see how effective certain months and days have been, as well as how effective the strategy has been to the long side and short side. However, it is the process of building the memory bank of what meets the rules and what does not meet the rules which is a very powerful aid in making trading decisions for the future.

Why start trading with Admiral Markets?

- Begin your trading with a well-established, reputable company that is authorised and regulated by the Financial Conduct Authority (FCA).

- Start trading on the world's most popular trading platform called MetaTrader for PC, Mac, Web, Android and iOS operating systems so you can also trade on the go.

- Supercharge and upgrade your trading platform completely FREE to the Supreme Edition for actionable trading ideas on thousands of different markets.

- Open a Trade.MT4 or Trade.MT5 trading account to trade via CFDs and potentially profit from both rising and falling markets.

One of the best ways to get started is to test-drive the trading platform and practice your ideas and strategies in a virtual trading environment. Did you know that you can open a FREE demo trading account with Admiral Markets? This means you can trade in a virtual trading environment until you are ready for a live account.

Get started today - completely FREE - by clicking on the banner below!

About Admiral Markets

Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8,000 financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. Start trading today!

This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or recommendation for any transactions in financial instruments. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks.

Welcome to this video on backtesting trading strategies. The irony is that using trading backtesting software may be the absolute worst way to design trading strategies.

Learning how to backtest a trading strategy using excel, MT4 or another software program seems like a good idea at first. But it’s not. This video and article will walk you through the logic of exactly why, and what to do instead.

Was this video on backtesting trading strategies, helpful to you? Leave a message in the COMMENTS section at the bottom of this page.

PLEASE “PAY IT FORWARD” BY SHARING THIS VIDEO & ARTICLE ON FACEBOOK OR TWITTER by clicking one of the social media share buttons.

BACKTESTING TRADING STRATEGIES

Welcome to this video on backtesting trading strategies I share with you my experience with backtesting which I have done for well I did do for many many years. I don’t do it anymore and I’m going to share with you why. I have very sophisticated software very high powered computer system and I was trained in how to do this I’d find a few strategies that were viable historically.

Then what you do typically is you understand that’s curve fitting. So then you take the successful strategies and you apply them to data that is separate from the data used historically that’s called out of sample forward testing. So most of them when I took them and use them on out of sample data they failed the night. Ninety five percent of them. So then that last 5 percent which is very hard to find.

TRADING BACKTESTING SOFTWARE

I would then start treating real live markets in current time and none of them were successful over the long period of time someone worked for a little while and then ultimately fail. So why is that. I started to wonder because I spend a lot of time on that and I was very disappointed. So I started thinking about it. I realized you know there are some real problems with the whole idea of backtesting. Here’s the first one.

You’ve seen this legal statement everywhere. Go ahead and fill in it just in your mind just fill in the the end of the sentence. Past performance is no guarantee of what you know the end of this. Most people do. We see it everywhere in websites and on documents that people send to us brokerage firm software whatever. Past performance is no guarantee of future results. This is why trading backtesting software isn’t reliable for futures profits.

HOW TO BACKTEST TRADING STRATEGIES IN MT4

So we’ve seen it everywhere. You knew that. That’s a problem. If that’s a legal statement that all these companies put on their documentation that means that that’s a very significant issue and it is in fact that many studies have been done on this Couple of a moment or in 2014 a Wall Street Journal study found that only about 14 percent of Five-Star funds retained their reading 10 years later.

Backtesting Trading Strategies Mt4 Tutorial

Past performance was not indicative of future results. In 2013 a Vanguard study reported that the one stars and now we’re looking at the other end The Wall Street Journal analyze the Five-Star at Vanguard study the one stars and they had the actual greatest excess returns what they call when compare it against a benchmark. So wow. What the heck’s going on. Yes I hate the opposite of what you would expect especially when most people make decisions on funds to buy based on their past performance. If this is true, then learning how to backtest trading strategies in mt4 may be futile.

HOW TO BACKTEST A TRADING STRATEGY USING EXCEL

Well to me what that indicates is there’s probably a reversion to the mean. We all know that very very few people ever outperform just the benchmark the S&P 500. And so therefore if it does outperform for a while it reverts back to the mean if it underperforms for awhile revert back to the mean. So that’s one huge problem.

Another one is that markets change over time. Back when I started trading which is decades and decades and decades ago I’d have to call my broker on a rotary phone of all things my kids don’t even know who the rotary phone is anymore. They see it in a museum. But yeah we didn’t I mean we had a black and white TV. So learning how to backtest a trading strategy using excel may not be applicable to today’s markets when using long-term historical data.

BACKTESTING TRADING STRATEGIES FREE

We certainly didn’t have computers. And so there’s no direct access. You know there were no low commissions commissions or high cost me 50 bucks to get in 50 bucks to get out decimalization wasn’t around. There was no mobile devices didn’t even have a computer. Bottom line was trading was slow slow and expensive and therefore chart patterns trended more today. People use all this technology to get in and out of the market real fast. That creates choppier chart patterns.

The patterns today are different than they were back then. Now that’s on the retail side. Now on the professional side you’ve got Elgood trading high frequency trading. It got dark pools. So the speed of what’s going on here in the retail around the professional sites even faster. And so again you get different type of chart patterns than you did in the past so. Add to that, the fact that many traders want to use backtesting trading strategies that are free and well, you get what you pay for!

FREE BACKTESTING

Okay that’s great. Now that all begs the question of all day what do we do. So the first thing to acknowledge is are no certainties in the market. Part of that reason we do free backtesting is we’re looking for some certainty as to what’s going to work in the future. And so acknowledge that there’s always risk in the market. You know back in the days of Jesse Livermore they used to call it speculation. I still prefer the term speculation to trading because it reminds me that there’s always risk in the market.

Here’s how I trade here the principles I use two things. Number one market logic and mathematical logic. So what do I mean by these. Well let’s take emerging market logic first. So I’m referring to the market profile model where the market is seen as an auction place and in an auction place you’re beating on memorabilia and so forth art whatever it might be and that that item that’s going to sell for whatever someone is willing to pay for it.

BEST WAY TO BACKTEST TRADING STRATEGIES

And that’s how the markets work too. We’ve got this global auction place essentially. But the logic of the markets not always logical. Sometimes people pay more than many people would think that a piece of art is worth because they have sentimental connection with that. And the same thing happens in the financial markets. So and we see that with bubbles. We’ve seen it in the real estate bubble recently. Before that we saw in the technology bubble before we even start with tulips. If you go back farther and of tulips of all beings and of course this is what Alan Greenspan referred to is as irrational exuberance.

The market logic is the logic of well logic in quotes of people and psychological studies have shown that people generally. Even though we don’t admit it to ourselves we generally make decisions based on emotion and justify them with logic. And so the market logic is not individual psychology but mass psychology that plays a major role in how markets move. Thus, there may be no best way to backtest trading strategies.

FREE BACKTESTING SOFTWARE

The second part of the larger equation that is the mathematical and got to include this too. Because over half of the shares in the New York Stock Exchange aren’t traded by human beings Well I should say they aren’t. The decisions the trading decisions are made by computer models and some of these don’t really affect you in your trading and you certainly can’t compete against them.

Backtesting In Mt4

You and I cannot compete against these. You’re not going to get free backtesting software or a forex robot on the Internet for $19 that it is going to compete with Goldman Sachs or Merrill or Bank of America. So here’s what I do. I combine these two types of logic. And the bottom line is that mathematically measuring what the market participants are doing now. So again remember it’s market participants globally and I’m taking a treat now.

I need to know what’s going on in the market right at the second entering the trade. Now what happened you know six months ago 12 months ago 40 years ago I trade in the present bar by bar and manage my risk and then I use indicators to objectively and mathematically measure the money flow in and out of the market. Now that’s what we’re looking for the money.

GET MY FREE MARKET ENTRY TIMING INDICATOR

BTW, if you’re interested in the indicator that I use personally for very precise entries and exits. I’m happy to share that with you. Just send me an email at support@topdogtrading.com, and I’ll show you how to get access to that indicator.

What did you think of this tutorial on backtesting trading strategies? Enter your answer in the COMMENTS section at the bottom of this page.

Backtesting Trading Strategies Mt4 Download

PLEASE PAY IT FORWARD BY SHARING THIS VIDEO & ARTICLE ON FACEBOOK OR TWITTER by clicking one of the social media share buttons.

FREE GIFT!

Also I’m giving away one of my favorite backtesting trading strategies that works in trading the markets. Just fill out the yellow form at the top of the sidebar on the right. Once you do that, I’ll personally send you an email with first video.

Those interested in the backtesting trading strategies also showed in interest in this video:

http://www.topdogtrading.com/heiken-ashi-strategy-trend-trading-unique-japanese-candlestick-chart-pattern/

Subscribe to my YouTube Channel for notifications when my newest free videos are released by clicking here:

https://www.youtube.com/user/TopDogTrading?sub_confirmation=1